Cryptocurrency, a digital or virtual form of currency that relies on cryptographic technology, has fundamentally reshaped the global financial landscape since the inception of Bitcoin in 2009. Over the past decade, this revolutionary technology has transcended its initial status as a fringe concept, becoming a cornerstone of innovative financial systems and technological advancements. As we look to the future, cryptocurrency’s trajectory promises profound implications for economies, societies, and technological ecosystems. This exploration of the future of cryptocurrency delves into its potential developments, challenges, and transformative impact.

Buy from Amazon > Cryptocurrency All-in-One For Dummies

Buy from Amazon > The Bitcoin Standard: The Decentralized Alternative to Central Banking 1st Edition

1. Mainstream Adoption and Integration

Cryptocurrency has steadily moved from niche circles to broader mainstream acceptance. Governments, financial institutions, and corporations are increasingly recognizing its potential. In the coming years, cryptocurrencies like Bitcoin, Ethereum, and others could become integral components of global financial systems.

Buy from Amazon > Crypto Seed Phrase Storage Notebook – Waterproof Stone Paper Book – Cryptocurrency Recovery Phrase Password Keeper – Cold Storage Wallet Backup Journal – Pocket Size 2-Pack

Buy from Amazon > Seedbook By Hodl My Seed – The Safest And Most Convenient Way To Store Your Crypto Recovery Seed Phrases. Securely Lock Your Cold Storage Keys In This Safe Password Notebook(1, Black)

a) Global Payment Systems

Cryptocurrencies are poised to redefine payment systems by offering faster, more secure, and cost-effective cross-border transactions. Traditional financial systems, plagued by high fees and slow processing times, could be supplanted by blockchain-based solutions. Emerging technologies such as the Lightning Network are already enhancing Bitcoin’s scalability, making it a viable option for everyday transactions.

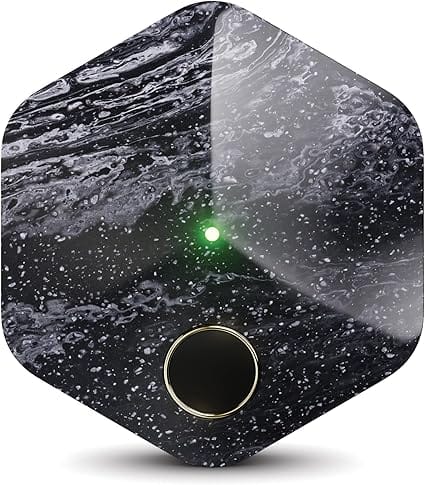

Buy from Amazon > Bitcoin Hardware Wallet

b) Institutional Investment

Institutional interest in cryptocurrency continues to grow. Investment firms, hedge funds, and even sovereign wealth funds are incorporating cryptocurrencies into their portfolios. As regulations become clearer, institutional capital inflows are expected to surge, bolstering the market’s credibility and stability.

Buy from Amazon > Wallet & Printer – Cold Storage Digital Crypto Hardware with 3in Color LCD Touchscreen, Secure Messaging and Digital Wallet for NFT, Crypto Currency and Tokens, All-in-one with Secure Printer

2. Decentralized Finance (DeFi)

DeFi has emerged as a disruptive force in the cryptocurrency ecosystem, offering decentralized alternatives to traditional financial services such as lending, borrowing, and trading. Powered by smart contracts on blockchain platforms like Ethereum, DeFi eliminates intermediaries, reducing costs and increasing accessibility.

a) Financial Inclusion

DeFi platforms hold the promise of bringing financial services to billions of unbanked individuals worldwide. With just a smartphone and internet access, users can participate in decentralized financial ecosystems, bypassing traditional barriers such as lack of credit history or geographic limitations.

b) Evolution of Financial Instruments

The future of DeFi includes the creation of increasingly sophisticated financial instruments. From tokenized assets to yield farming and liquidity pools, DeFi could reshape how we interact with money, potentially blurring the lines between traditional and decentralized finance.

3. Central Bank Digital Currencies (CBDCs)

Governments and central banks around the world are exploring the development of CBDCs, digital currencies issued and regulated by central authorities. Unlike cryptocurrencies like Bitcoin, CBDCs aim to combine the efficiency of digital transactions with the stability of fiat currencies.

a) Complementing Cryptocurrencies

CBDCs are likely to coexist with decentralized cryptocurrencies, offering an alternative that provides government-backed security. This dual ecosystem could promote broader adoption of digital currencies while maintaining regulatory oversight.

b) Impact on Monetary Policy

CBDCs could revolutionize monetary policy by providing central banks with more precise tools for economic management. For example, programmable money could enable targeted stimulus distribution, ensuring funds reach intended recipients directly.

4. Technological Advancements

The cryptocurrency industry’s future is intertwined with advancements in blockchain technology and related fields. Innovations will likely enhance scalability, security, and sustainability, addressing some of the current limitations of cryptocurrencies.

a) Layer 2 Solutions

Layer 2 solutions, such as rollups and sidechains, are being developed to improve blockchain scalability. These technologies could dramatically increase transaction speeds and reduce costs, paving the way for mass adoption.

b) Interoperability

The future of cryptocurrency relies on seamless interoperability between different blockchain networks. Projects like Polkadot and Cosmos are pioneering this space, enabling cross-chain communication and fostering a more cohesive blockchain ecosystem.

c) Sustainability

Environmental concerns surrounding energy-intensive proof-of-work (PoW) systems like Bitcoin have prompted exploration of more sustainable alternatives. Proof-of-stake (PoS) and other consensus mechanisms are gaining traction as eco-friendly options that maintain network security and efficiency.

5. Regulatory Developments

Regulation will play a pivotal role in shaping the future of cryptocurrency. While the decentralized nature of cryptocurrencies has been a significant draw, it has also raised concerns about fraud, money laundering, and market manipulation.

a) Global Regulatory Frameworks

Countries are working towards establishing comprehensive regulatory frameworks that balance innovation with consumer protection. International cooperation will be essential to address the borderless nature of cryptocurrencies and prevent regulatory arbitrage.

b) Taxation and Compliance

Clear guidelines on taxation and compliance will encourage broader participation in the cryptocurrency market. Simplified tax reporting and standardized compliance procedures could alleviate concerns among investors and businesses.

6. Metaverse and Non-Fungible Tokens (NFTs)

The rise of the metaverse and NFTs represents a new frontier for cryptocurrencies. These digital assets are becoming integral to virtual economies, enabling ownership and monetization of digital goods and experiences.

a) Virtual Economies

Cryptocurrencies are the backbone of metaverse economies, facilitating transactions in virtual worlds. As the metaverse expands, demand for interoperable and scalable cryptocurrencies is likely to grow.

b) Digital Ownership

NFTs have redefined concepts of ownership in the digital age. From art and music to virtual real estate, NFTs enable creators and consumers to engage in new ways. The integration of NFTs with cryptocurrencies could unlock innovative business models and revenue streams.

7. Challenges and Risks

Despite its transformative potential, the future of cryptocurrency is not without challenges. Addressing these issues will be crucial for sustainable growth and widespread adoption.

a) Volatility

Price volatility remains a significant barrier to cryptocurrency adoption. Stablecoins, which are pegged to fiat currencies or other assets, offer a potential solution but require robust mechanisms to maintain stability.

b) Security Concerns

Cybersecurity threats, including hacks and fraud, pose risks to the cryptocurrency ecosystem. Continued investment in security infrastructure and user education will be essential to building trust.

c) Regulatory Uncertainty

Unclear or restrictive regulations could stifle innovation and hinder adoption. Engaging with policymakers and demonstrating the benefits of cryptocurrency will be vital for its future success.

8. Social and Economic Implications

Cryptocurrency’s impact extends beyond finance and technology, influencing social and economic dynamics worldwide.

a) Empowerment Through Decentralization

Cryptocurrencies empower individuals by providing financial autonomy and reducing reliance on centralized institutions. This democratization of finance could help bridge wealth gaps and promote economic equality.

b) Redefining Employment

The gig economy and remote work trends are accelerating cryptocurrency’s adoption as a payment method. Freelancers and digital nomads are increasingly using cryptocurrencies for borderless, fast, and secure transactions.

c) Cultural Shifts

Cryptocurrencies are fostering cultural shifts, particularly among younger generations who value decentralization and digital innovation. This generational change could drive long-term adoption and integration of cryptocurrencies into daily life.

Conclusion

The future of cryptocurrency is a dynamic and multifaceted journey. From revolutionizing global payment systems and fostering financial inclusion to reshaping digital ownership and redefining economies, the potential of cryptocurrencies is boundless. However, achieving this vision will require addressing significant challenges, including regulatory uncertainty, technological limitations, and security risks.

As governments, institutions, and individuals continue to explore the possibilities of cryptocurrency, collaboration and innovation will be key. By harnessing the transformative power of blockchain technology and addressing its associated risks, the world stands on the brink of a new era in finance and beyond. The journey ahead promises to be as disruptive as it is exciting, with cryptocurrency at the forefront of shaping our digital future.

Best Cryptocurrencies to Buy in 2025: A Comprehensive Guide

Cryptocurrencies have become a significant investment avenue, offering innovative technology, decentralized finance, and substantial returns to early adopters. With the cryptocurrency market continually evolving, identifying the best options to invest in can be daunting. In 2025, as the market matures, several cryptocurrencies stand out due to their potential for growth, utility, and adoption.

Below is a detailed exploration of the top cryptocurrencies to consider buying in 2025, based on factors like market performance, use cases, and technological innovation.

1. Bitcoin (BTC)

Bitcoin, the first cryptocurrency, remains the most popular and valuable digital asset in the world. Its decentralized nature, limited supply of 21 million coins, and status as a store of value make it an attractive investment.

- Why Buy Bitcoin?

- Institutional Adoption: Bitcoin has witnessed increasing adoption by institutional investors, making it a reliable asset for long-term growth.

- Digital Gold: Bitcoin is often referred to as “digital gold” due to its potential as a hedge against inflation and economic uncertainty.

- Liquidity: As the most liquid cryptocurrency, Bitcoin allows easy entry and exit for investors.

- Risks:

- Volatility remains a concern.

- Energy-intensive mining operations raise environmental concerns.

2. Ethereum (ETH)

Ethereum is more than just a cryptocurrency; it’s a platform for decentralized applications (dApps) and smart contracts. Its transition to Ethereum 2.0 and the Proof of Stake (PoS) consensus mechanism has further cemented its position as a leading blockchain network.

- Why Buy Ethereum?

- Smart Contracts and dApps: Ethereum powers countless dApps, including DeFi platforms and NFTs, making it indispensable in the blockchain ecosystem.

- Scalability Improvements: Ethereum’s upgrades promise faster and more efficient transactions.

- Wide Adoption: Major industries use Ethereum for diverse applications, from finance to supply chain management.

- Risks:

- Competition from other Layer 1 blockchains.

- Gas fees can still spike during high network demand.

3. Binance Coin (BNB)

Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest crypto trading platforms globally. Its utility extends beyond trading fee discounts, with applications in payments, token sales, and DeFi.

- Why Buy Binance Coin?

- Exchange Dominance: Binance’s dominance ensures consistent demand for BNB.

- Burn Mechanism: Regular coin burns reduce supply, potentially increasing its value over time.

- Ecosystem Growth: BNB powers the Binance Smart Chain (BSC), which supports various dApps and DeFi projects.

- Risks:

- Regulatory challenges faced by Binance could impact BNB.

- Competition from other exchange tokens and blockchains.

4. Cardano (ADA)

Cardano is a third-generation blockchain platform focusing on scalability, sustainability, and security. Its research-driven approach and eco-friendly proof-of-stake system have attracted significant attention.

- Why Buy Cardano?

- Scalability: Cardano’s Ouroboros PoS protocol is designed for efficiency and scalability.

- Strong Community: A dedicated developer and user community supports Cardano’s ecosystem.

- Real-World Use Cases: Cardano’s partnerships in education, agriculture, and finance highlight its practical applications.

- Risks:

- Slow-paced development compared to competitors.

- Lack of widespread adoption for dApps.

5. Solana (SOL)

Solana has emerged as one of the fastest blockchains, capable of handling thousands of transactions per second. Its high throughput and low transaction costs have made it a popular choice for DeFi and NFT projects.

- Why Buy Solana?

- Speed and Efficiency: Solana’s blockchain is optimized for speed and cost-efficiency.

- Growing Ecosystem: The network has a thriving ecosystem of DeFi protocols, games, and NFT platforms.

- Developer-Friendly: Solana’s robust tools attract developers to build on its platform.

- Risks:

- Network outages have raised concerns about reliability.

- Intense competition from other high-performance blockchains.

6. Polkadot (DOT)

Polkadot is a blockchain platform enabling interoperability between different blockchains. Its unique multi-chain technology facilitates seamless communication and data transfer.

- Why Buy Polkadot?

- Interoperability: Polkadot connects multiple blockchains, solving one of the industry’s biggest challenges.

- Scalability: The platform’s parachain structure allows high scalability.

- Strong Development Team: Polkadot’s creators include Dr. Gavin Wood, a co-founder of Ethereum.

- Risks:

- Complex architecture could lead to technical challenges.

- Slower adoption compared to some competitors.

7. Ripple (XRP)

Ripple’s XRP is a digital payment protocol designed to enable fast and cost-effective cross-border transactions. Despite legal challenges, XRP remains a top choice for financial institutions.

- Why Buy XRP?

- Partnerships: Ripple collaborates with major banks and financial institutions globally.

- Use Case: XRP’s utility in cross-border payments ensures demand.

- Efficiency: Transactions on Ripple’s network are fast and energy-efficient.

- Risks:

- Ongoing legal battles with the SEC could impact XRP’s future.

- Limited decentralization compared to other cryptocurrencies.

8. Avalanche (AVAX)

Avalanche is a high-performance blockchain platform designed for scalability, speed, and customizability. It offers a unique consensus mechanism and supports multiple subnets for diverse use cases.

- Why Buy Avalanche?

- High Throughput: Avalanche can process thousands of transactions per second.

- Custom Subnets: Developers can create tailored blockchains within the Avalanche ecosystem.

- Eco-Friendly: Its PoS mechanism is energy-efficient.

- Risks:

- Relatively new compared to competitors.

- Faces stiff competition from Ethereum and Solana.

9. Chainlink (LINK)

Chainlink is a decentralized oracle network that connects smart contracts with real-world data. Its role as a bridge between blockchain and external systems makes it a crucial part of the crypto ecosystem.

- Why Buy Chainlink?

- Wide Adoption: Chainlink oracles are used by numerous DeFi and blockchain projects.

- Unique Utility: It addresses a critical need for reliable data in blockchain applications.

- Strong Partnerships: Collaborations with major companies enhance its credibility.

- Risks:

- Dependence on Ethereum may limit its scalability.

- Competition from other oracle solutions.

10. Polygon (MATIC)

Polygon, formerly Matic Network, is a Layer 2 scaling solution for Ethereum. It enhances Ethereum’s capabilities by providing faster and cheaper transactions.

- Why Buy Polygon?

- Ethereum Compatibility: Polygon benefits from Ethereum’s robust ecosystem.

- Scalability: Its Layer 2 solution offers significant improvements in transaction speed and cost.

- Diverse Applications: Supports a variety of dApps and blockchain projects.

- Risks:

- Dependence on Ethereum’s success.

- Competition from other scaling solutions.

11. Litecoin (LTC)

Litecoin is often considered the silver to Bitcoin’s gold. It’s a peer-to-peer cryptocurrency designed for fast and low-cost payments.

- Why Buy Litecoin?

- Longevity: Litecoin has been a reliable cryptocurrency since 2011.

- Faster Transactions: Compared to Bitcoin, Litecoin offers quicker transaction confirmations.

- Widespread Acceptance: Accepted by many merchants and payment platforms.

- Risks:

- Limited innovation compared to newer cryptocurrencies.

- Declining market share.

Conclusion

The cryptocurrency market offers a diverse range of investment opportunities. While Bitcoin and Ethereum remain staples for any portfolio, emerging projects like Solana, Avalanche, and Polygon provide high-growth potential. Each cryptocurrency has unique features and risks, so thorough research and diversification are crucial when investing.

As the market evolves, factors like regulation, technological advancements, and adoption trends will significantly influence the performance of these digital assets. Investors should stay informed and consider their risk tolerance and investment goals when choosing the best cryptocurrencies to buy in 2025.

The History of Bitcoin

Bitcoin, the world’s first decentralized cryptocurrency, was conceptualized in 2008 and brought to life in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. The initial idea, detailed in the whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” proposed a revolutionary financial system that would enable direct transactions between parties without reliance on traditional financial intermediaries like banks.

The genesis block of Bitcoin, known as “Block 0,” was mined on January 3, 2009. Embedded in its code was a message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” symbolizing Bitcoin’s aim to challenge the central banking system during a time of global financial instability.

Bitcoin’s design was built on blockchain technology, a distributed ledger system that records transactions across a network of computers. This innovation ensures transparency, security, and immutability, solving the issue of “double spending” without needing a centralized authority.

Initially, Bitcoin was a niche project, embraced mainly by cryptography enthusiasts. The first real-world transaction involving Bitcoin occurred in 2010 when programmer Laszlo Hanyecz famously purchased two pizzas for 10,000 BTC. As the Bitcoin network grew, it began to attract a broader audience, including investors, developers, and businesses intrigued by its potential as both a currency and a store of value.

Bitcoin’s value started to rise significantly in the early 2010s, bringing increased attention but also controversies. Its pseudonymous nature made it popular on dark web marketplaces like Silk Road, drawing scrutiny from governments and regulators. Despite challenges, Bitcoin continued to gain legitimacy, with companies like Overstock, Microsoft, and Tesla eventually accepting it as payment.

Over the years, Bitcoin has experienced dramatic price fluctuations, inspiring debates about its role in the global economy. Its popularity spurred the development of thousands of alternative cryptocurrencies, collectively known as altcoins. Bitcoin also became a cornerstone of the broader blockchain and decentralized finance (DeFi) movements.

Today, Bitcoin is widely recognized as digital gold and a hedge against inflation, with a market cap that has surpassed $1 trillion at its peak. It remains a symbol of financial independence and a catalyst for innovation in the digital age.